Some inbound agents are proactively working to reflect the new zero-rated. Export of zero rated goods or services.

Klang Malaysia June 2 2018 Milo Cans Stacked On The Shelf In Supermarket N N Ad Ad June Klang Malaysia Milo Malaysia Klang Greeting Card Display

Typically the Zero-Rated ZR code is reserved for zero-rated supplies such as beef rice sugar water and electricity.

. In other words they are subject to zero percent tax rate. GST is charged at 0 if they fall within the provisions under Section 21 3 of the GST Act. Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer.

Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer. Your services are considered international services which are zero-rated ie. Standard rated GST supplies.

As such the rate reduction from the current 6 to 0 will be reflected on transactions related to MYXpats charges from 1 June 2018 onwards. An event management company charges a fee for organising a concert in Malaysia. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

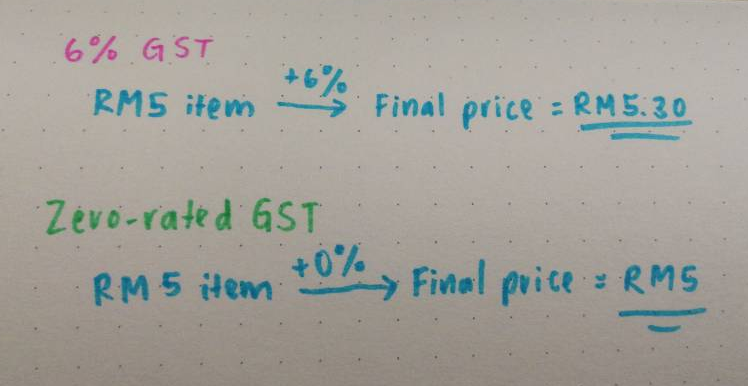

How GST works on a zero rated supply at the wholesale level. Malaysias unpopular 6 per cent GST was zero rated by the new Mahathir Mohamad administration to fulfil an election promise. Computation of GST on zero rated supply.

As the name suggests GST zero-rated supply means that the goods and services that fall under this category are not taxed. And b any supply of goods if the goods are exported. 1 A zero-rated supply is a any supply of goods or services determined to be a zero-rated supply by the Minister under subsection 4.

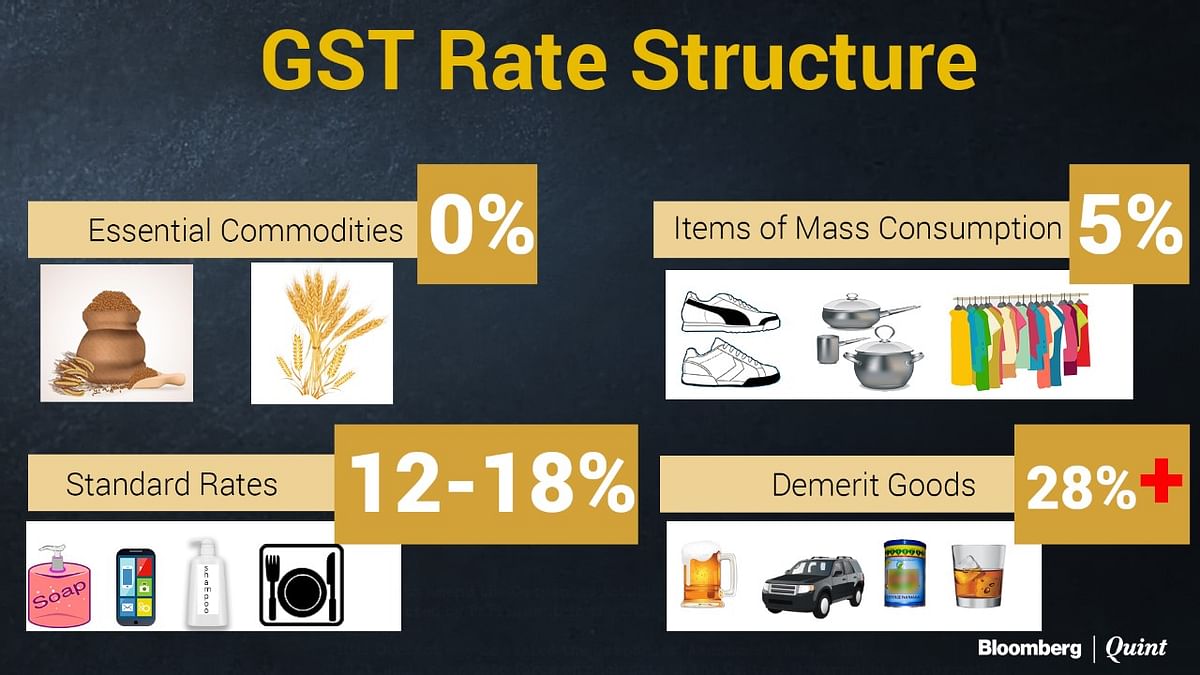

Business owners in Malaysia. In Malaysia theres standard-rated which is 6 zero-rated 0 and exempt GST. The Goods and Services Tax GST.

Computation of GST on zero rated supply. Your services are considered international services which are zero-rated ie. GST zero rated from June 1.

Whether the customer is a local or an overseas entity. So the standard-rate will automatically become zero-rated come 1 June but exempt supply will remain exempted from tax. 2 Where a taxable person supplies goods or services and the supply is.

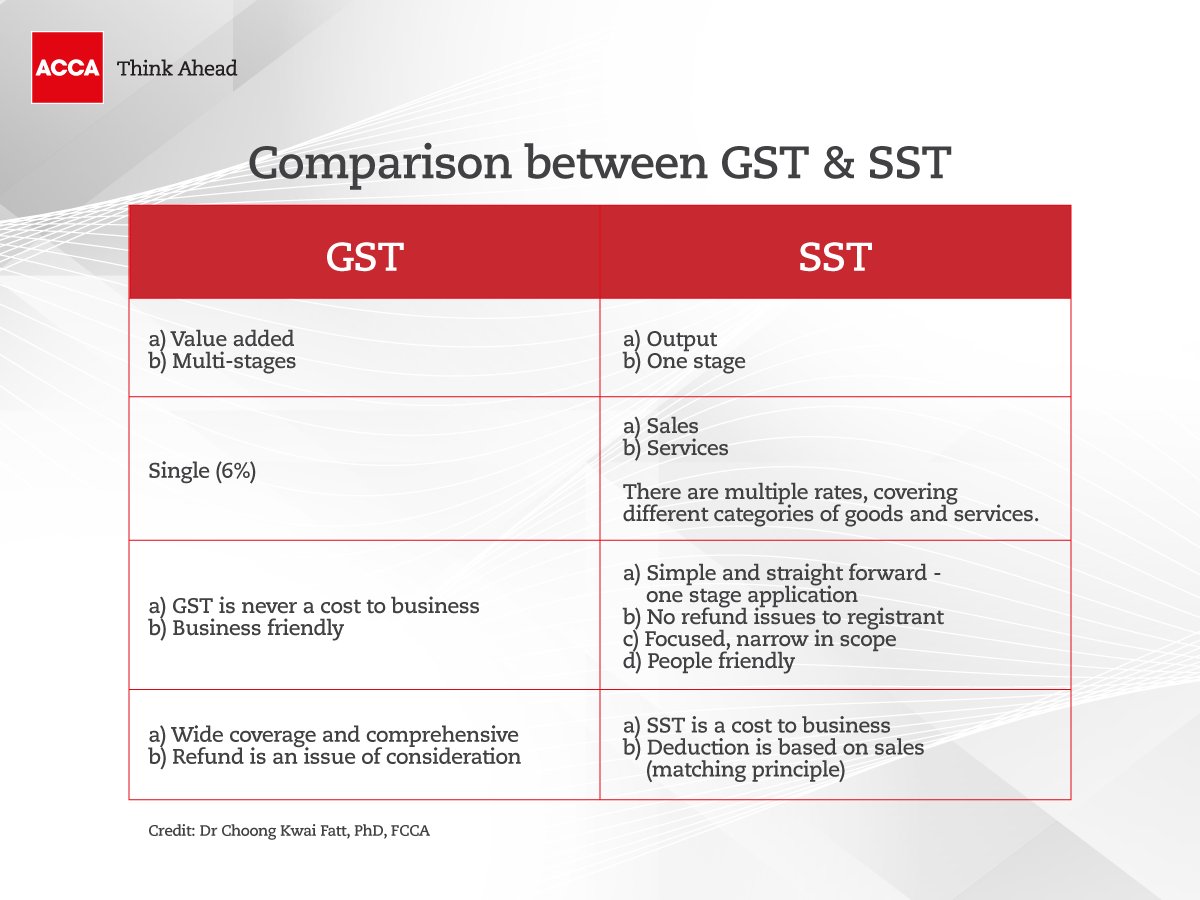

Zero rated GST will be applicable on future appointments even though they have been booked before the GST rate change. An industry hopeful of the benefits that Malaysias latest tax changes will bring is reacting in different ways as the zero-rated goods and services tax GST policy kicks into place starting today until August 31 after which it will be replaced by the sales and services tax SST from September 1. After spending the last several hours and night reading through the GST Act talking to tax accountants GST experts and scouring.

GST code Rate Description. The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 2018 the Finance Ministry announced today. Malaysias GST is zero-rated starting from 1 June 2018.

The Goods and Services Tax GST will be set to zero percent 0 effective from 1 June 2018 as announced by the Ministry of Finance Malaysia on 16 May 2018. The existing standard rate for GST effective from 1 April 2015 is 6. How GST works on a zero rated supply.

These are taxable supplies that are subject to a zero rate. The move by the government to zero-rate the goods and services tax GST is a step in the right direction say experts. The finance ministry MoF announced yesterday that goods and services within Malaysia and those imported from abroad which incur GST of 6 will see the rate reduced to 0 from June 1.

Companies are still required to adhere to the zero-rate and continue to comply to all GST requirements under the current legislation which includes the issuance of tax invoices GST tax codes. In other words no effect la so we dont have to go too deep into this. The Standard-Rated SR code is for.

Zero rated supply of goods or services locally. This does not cover goods. Dont panic this one only requires a short explanation.

GST zero-rating for sales of exported goods. Depending on the nature of your services you may be required to determine. How GST works on a zero rated supply at the wholesale level.

These are taxable supplies that are subject to a zero rate. Under this category the taxable company doesnt need to collect any GST on sales. The Goods and Services Tax GST Board of Reviewin a decision favourable to the traderaddressed the tax authoritys decision to deny zero-rating for exports of goods that were hand-carried by motor vehicle to customers in Malaysia.

GST is charged at 0 if they fall within the provisions under Section 213 of the GST Act. But the company is most certainly. The GST will be fully scrapped after the government repeals the Goods.

Malaysia-Singapore Coffeeshop Proprietors General Association president Ho Su Mong said with zero-rated GST more coffeeshop owners would be moved to reduce the price of drinks and foodstuff. Here is what companies should know about the change in the tax environment of the country. The case is.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. When you click the link a 0 tax is applied on the invoice and the price is. How GST works on a zero rated supply.

The ministry said the GST will no longer be imposed at a rate of 6 per cent from then on adding that this will be subject to further notice. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 SR. After you change the tax group rate from 6 to 0 in Zenoti when you open any invoice that has a GST rate of 6 a link to recalculate appears.

Depending on the nature of your services you may be required to determine your customers belonging status ie. What is GST Zero-Rated Supply in Malaysia. A young boy poses with a poster asking for the GST to be abolished during a May Day rally in Kuala Lumpur on May 1 2014.

What S The Difference Between Abolishing Gst And Zero Rating It

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Gst Global Perspectivegoods And Services Tax In Australia Consumption Tax Is Called Value Added Tax Consumption Tax Personal Finance Presentation

What S The Difference Between Abolishing Gst And Zero Rating It

Business As Usual But Customers Reap Rewards As Zero Rated Gst Kicks In Across The Causeway Today

Accamalaysia No Twitter As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize This Opportunity

Notice Gst Zero Rated Effective On June 2018 Enagic Malaysia Sdn Bhd

India Gst The Four Tier Tax Structure Of Gst

Malaysia S Zero Rated Gst A Move Forward Or Several Steps Back Priority Consultants

A Guide To Gst In Malaysia How Does It Affect Me

Malaysia Sst Sales And Service Tax A Complete Guide

Post Ge14 Gst To Be 0 From June 1 But M Sians Still Have Questions

If An Exporter Having Gst Registration Makes An Exempted Or A Zero Rated Supply He Is Required To Follow The Revised Process For Refund Tax Credits Procedure

A Guide To Gst In Malaysia How Does It Affect Me

A Guide To Gst In Malaysia How Does It Affect Me

Analysis Of Goods And Services Tax Gst Structure